Well, May was interesting. I officially scaled back some of my outside work and focused on writing, and online work (p.s. if you need a writer, holler!)

Overall, it has been going pretty well. I’m juggling my full-time work, with my freelance responsibilities, while making sure I rest, spend time with my man, and still have an awesome life. I seriously don’t know how some of you do it. I applaud you.

Financially, May was a rough month. Right before heading to the Oregon Coast for Memorial Day, my boyfriend’s car had a flat tire. 2 tires and $210 later we were on our way to the coast. I probably spent another $200 at the coast. Although it was Memorial Day, we decided to celebrate our 6-year anniversary a bit early. Our actual anniversary is in 2 weeks, but he has a gig. It was so wonderful to spend some alone time, away from the computer, and just enjoy the sunshine.

After saying ‘I love you’ after three weeks of dating. At a karaoke bar, of course.

In addition, I purchased some concert tickets for later in the summer, and also had to put a very large expense on my credit card, for which I will be reimbursed. I also increased my retirement contributions from $50/month to $100/month.

To save you from suspense, I have to sadly admit that this has been the worst month for repayment since I started the blog in January 2013. 🙁

I was only able to put $366 to debt.

My current debt total is: $39,991.96

That is dangerously close to $40k and I can’t wait to make another payment. Usually I’d beat myself up over this, but here is why I’m not sweating it:

- I don’t regret the money spent on our anniversary one bit

- The tires were overdue for a change

- I will get reimbursed a large amount of money, for expenses I had to pay for upfront (i.e. the money is coming).

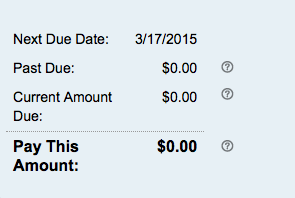

Also, it feels pretty rad to log into my account and see this:

I’m ahead, my loans aren’t even due until next year! Hehe, but I won’t be slacking off. Once I get reimbursed, I am going to throw the rest of it back to my student loans. I also expect to get some more checks this month. Although I was thrilled at putting $1400 to debt last month, this month was a disappointment. But that’s the name of the game with debt. Up, and down, joy, and pain — it’s a roller coaster.

I’m ahead, my loans aren’t even due until next year! Hehe, but I won’t be slacking off. Once I get reimbursed, I am going to throw the rest of it back to my student loans. I also expect to get some more checks this month. Although I was thrilled at putting $1400 to debt last month, this month was a disappointment. But that’s the name of the game with debt. Up, and down, joy, and pain — it’s a roller coaster.

So watch out June — I’m coming for you!

- Talking About Money and Mental Health - September 12, 2022

- Dear Debt, We’re Better Apart - June 27, 2022

- Announcing The Mental Health and Wealth Summit - May 4, 2021

31 comments

That’s the spirit! Are you going to benefit from any additional income from your on-line work, or is it basically replacing for the work you did before?

Yes, I am! It’s been nice. If you have specific questions, feel free to email me, but yes I’m making more than doing some of the other stuff, which is a great bonus.

Cute pic. 🙂 We had a rough month for May too. Lots of extra expenses, and it’s SO discouraging sometimes!!!!

Thanks! 🙂 Oh, love! It can be disheartening, but we got this Laurie!

I know it sucks that you didn’t put away as much as you wanted this much, but I love your attitude about it. You just have to take everything in stride. Life sometimes gets in the way, but at least you are focused on how you are going to make it up. AND, I love that picture of you!! You look so happy! (who wouldn’t be after confessing love over karaoke?) 🙂

June is going to be so much better! At least I know the reasons May wasn’t that great, and they aren’t all bad. I think this is the happiest picture I have of myself. Pure, genuine smile, right after confessing our love after a ridiculously short amount of time. I remember thinking the relationship would be a long simmer or burn out quickly. Glad it was the former. 🙂

Awe I’m sorry May wasn’t that great for student loan repayment, but it sounds like there were some other great things that happened this month. The Oregon coast is so pretty! I’m super jeals you got to hang out there. I really need to take a weekend off and my producer has already once again asked me to work this weekend. I think he is now using my fear of it really slowing down and possibly taking advantage of me. I really want to say no, but I’m afraid it really will slow down, but I have no way of knowing for sure. Anyway, here is to a kick ass June for both you and I!

The Oregon coast is magical! Aww, sorry to hear you are working again this weekend. You definitely need a break! Don’t let fear rule you. You are awesome and will make it work.

We all have tough months. I was SURE that June would be better than May, but I had a big disaster on May 31 for which I had to pay for on June 1… Ah well, there’s always July! I’m still going to try to make June as good as possible [though I know my debt total will be increasing :(]

Oh no! That’s the worst. 🙁 You do what you can, when you can.

Woohoo for being under $40k! Happy 6 year anniversary to you and your bf Melanie! For being a meltdown, May sounds like it was actually quite lovely for you. 🙂 Here’s to a better June!

Hehe yeah it was. You know I have a penchant for being dramatic, lol.

Aw, Happy (early) Anniversary to you two! Celebrating that and making new memories is definitely a good reason to spend. I’m glad you don’t have any regrets. Our three year mark is coming up in September and we’re still not sure what we’ll be doing. May was pretty ridiculous for me, too, but I know June will be better.

I believe in celebrating with the one you love. Especially if you have hardly seen each other lately! June will be better!

I guess there are some months where putting anything towards debt at all has to be considered a success! It’ll feel better when that delayed check comes in though.

Exactly! I can’t wait to get my checks and make June a wild success.

May was pretty crappy for me too, gotta reign it in. I know you didn’t pay what you wanted to your debt this month but its pretty awesome that you’ve paid half of what you originally owed and are a year ahead of the game! You should be very proud of what you’ve accomplished, this month was just a minor bump in the road.

Yes, I have to look at the bright side. I have so much to look forward to. Not every month is going to be amazing.

I wouldn’t regret spending money on an anniversary either. There are some things you have to spend on because they are experiences that mean something.

Funny enough I didn’t have a good month in May debt payment wise but June is looking so much better. We just have to bounce right back!

Yep! Just keep on going down the path….

Glad to hear you got to get away for a while and relax!

I had a similar month. Didn’t put as much toward my debt as I wanted, but I plan to make up for it in June!

It was so lovely! Sounds like May was rough for a lot of people.

We’re all going to have months like this. My May wasn’t amazing either

I still have to sit down and figure it all out for my post but I’m pretty sure I came up short on my goal.

Our five year wedding anniversary is coming up too and it has been way too long since we did anything nice so it will be well overdue! Here’s hoping June is better 🙂

Ooo you guys should do something nice for your 5 year anniversary. Spending time together is so important!

The way I see debt, as long as you are consistently making payments you are heading in the right direction. I don’t put extra money towards our loans, but I just keep telling myself as long as I keep making these payments I am slowly chipping away at a seemingly unfathomable total.

“a seemingly unfathomable total.” UGH I know. Progress is progress.

I love that pic of both of you (and love even more that you said I love you in a karaoke bar… ours was a dive bar :)) – Happy Anniversary! I agree, too, that tires are pretty essential, so those are good calls. I hope you have a better June. 🙂

Hehe thanks! 🙂 It’s my fav photo of us. So genuine and loving.

Cute picture. It pisses me off when things like the tires happen. I just think, “well this certainly isn’t how I dreamed of spending this money”.

Thanks! It makes me happy. I know, the tires were annoying. So much better things to spend money on! But necessary, I guess.

That picture is super cute. 🙂 I’m sorry to hear that last month wasn’t so great, but honestly… not every month can be a winner… and you’re still kicking butt. No required payment until March of next year is kind of crazy!