On Monday, I was feeling down and out, frustrated with my seemingly lack of progress. After making another $600 payment on my student loans, I decided to crunch the numbers.

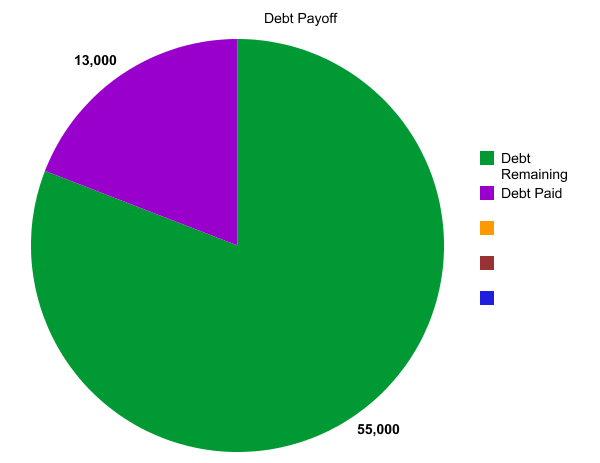

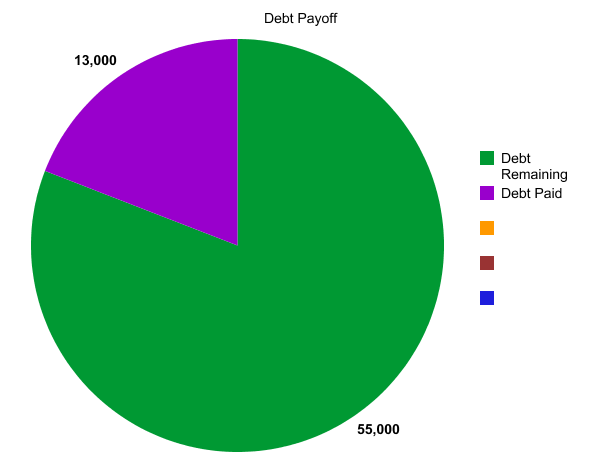

I’ve paid off roughly $13,000 out of my original $68,000 balance in 18 months. That’s 19% of my total debt! I say roughly because I’ve actually paid off more than that, but so much has been swallowed mercilessly to the 7.9% interest.

I must say I feel pretty good about that! I am amazed at the progress given my very low income the past two years. In 2011, I made approximately $16,000. After doing my taxes, this year is only slightly better at $20,000. Granted, the first salary was being a student in NYC and the latter is living in the much cheaper, Portland, Oregon.

Although mathematically it seems almost impossible that I paid off that much with that salary, I have to say it was due to frugality and saving. And student loans. Every semester in college when I received my student loan refund, which is used to pay for living expenses, I challenged myself to not touch it and only live off what I made at my three jobs. I was pretty successful and graduated with over 10k in savings. I wanted to just pay it back right away, but I knew I would need it with my move and job instability. Now I’ve dipped a lot into my savings, realizing that my money goes further paying off debt than sitting in savings.

Although I wish to throw every cent of my savings at my debt, I have to be realistic. I still don’t have a permanent job, health insurance or a credit card. Some financial prudence is needed until I find some stability. It’s easy for me to get discouraged both at my debt payoff and my job prospects. I miss the stability, culture and salary of 38k at my old job. In short, I miss my old life and have significantly downgraded in lifestyle. In my own Greek tragicomedy, it’s the most painful and bitter peripeteia. I left that job and went to graduate school thinking I was on to bigger, better things. In my hubris, I was confident I could easily make more than 38k after receiving a master’s. But sometimes, life is a kick in the head.

I am still trying to stay positive, focused and goal oriented. It’s been a long, long time coming, but change is gonna come. Next big goal: get under 50k and find that permanent job!

- Talking About Money and Mental Health - September 12, 2022

- Dear Debt, We’re Better Apart - June 27, 2022

- Announcing The Mental Health and Wealth Summit - May 4, 2021

7 comments

I’m going through something similar, so it’s nice to see others making progress. I’ll check earlier posts to see what your process was like, but great job with the 20% debt payoff!

I completely understand what you mean when you say life is a kick in the head sometimes. I went to school (and apparently $45K+) in debt to become a teacher. I am no longer a teacher but the debt remains and I just have to try and stay positive, focused and goal oriented. But sometimes it’s so hard!!!

I totally understand! It IS so hard…..this is NOT the life I thought I would have post-master’s degree. But I am confident it will change and am trying to stay positive myself! We can do it.

It’s easy to get down about progress until you look back at the overall progress you’ve made. I too miss my cushy job sometimes. I think I’d love freelancing more if my income was better than it is now, but it’s not quite there yet.

I agree! If things were stable and more economically viable I wouldn’t be eyeing the past with such disdainful nostalgia. But, we must live in the present and try to make our futures even better!

Student loan debt never looks like it goes anywhere. It doesn’t help that I was making hardship payments most of last year; over $1000 worth of payments and only $100 paid off!

Ugh, that’ so awful! I can’t stand student loan interest for this very reason. I get $400 of interest tacked on each month, so any payment below that is seemingly pointless. It’s so painful to pay 1k and only see $100 paid off….it’s especially hard when you know how far that money can go for you or others.